Which is better checking or savings account?

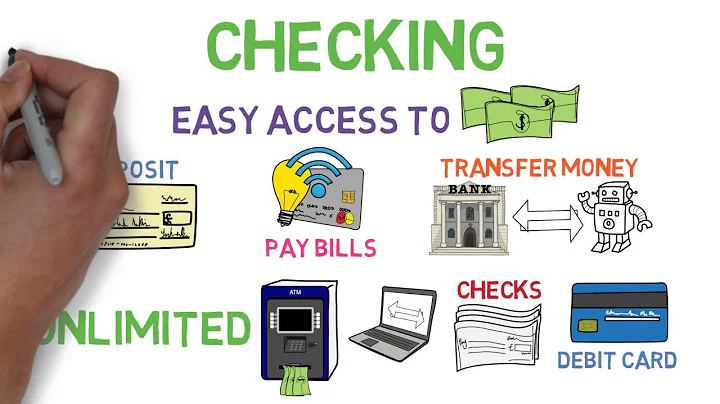

Checking accounts are better for regular transactions such as purchases, bill payments and ATM withdrawals. They typically earn less interest — or none. Savings accounts are better for storing money. Your funds typically earn more interest.

If your goal is to build your savings, savings accounts are often far better places to keep your money than checking. A savings account is the ideal place for money you don't need to spend right now but can't afford to lose.

With savings accounts, funds are less accessible, since these accounts are made to store money for financial goals. Checks can't be written against them, and you're generally limited to six free withdrawals or transfers a month from the account.

Savings accounts aren't immune to traditional and online security threats, but they're arguably the most secure place to keep your money.

How checking and savings accounts differ. The primary benefit of a checking account is to provide you with access to your money for everyday needs. Savings accounts, on the other hand, enable you to set aside money for longer-term goals. Savings accounts pay interest on balances.

Scott Cole, an Alabama-based CFP at Cole Financial Planning and Wealth Management, suggests thinking of a checking account solely as “a conduit through which money comes in and quickly goes out.” For this reason, the money in your account doesn't need to be too much more than what you need to cover your planned ...

Keeping too much of your money in savings could mean missing out on the chance to earn higher returns elsewhere. It's also important to keep FDIC limits in mind. Anything over $250,000 in savings may not be protected in the rare event that your bank fails.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

Savings account benefits include safety for your savings, interest earnings and easy access to your money. However, savings accounts may have drawbacks, such as variable interest rates, minimum balance requirements and fees.

You can use a savings account to build an emergency fund, save for large purchases, or set aside money for future needs. They're not good for regular transactions, however, as many are limited to six withdrawals per month, though you can withdraw as much as you'd like with each withdrawal.

How much money should you keep in your checking account?

In other words, it's a good idea to have at least one to two months' worth of expenses in your checking account. If you make a transaction when there isn't enough money in your account to cover it, you could be charged an overdraft fee.

Another person can only take out money from your savings account if you give them your private information, including your bank account number. To avoid debit card fraud, monitor your bank account transactions routinely.

Disadvantages of a Checking Account

Little to no interest: These accounts are for everyday spending, not for generating interest. Fees: People without direct deposit who cannot meet the minimum required balance will have to pay monthly service fees.

How Much Cash to Keep in Your Checking vs. Savings Account. Aim for about one to two months' worth of living expenses in checking, plus a 30% buffer, and another three to six months' worth in savings.

Checking accounts are better for regular transactions such as purchases, bill payments and ATM withdrawals. They typically earn less interest — or none. Savings accounts are better for storing money. Your funds typically earn more interest.

While you can have a checking and savings account separately — because each serves a different purpose — they can both be helpful for long term financial health and reaching your financial goals.

Protecting Your Money in the Bank

Since your savings accounts usually aren't connected directly to your debit card, the funds in savings should be safer from debit card thieves.

“Millionaires' checking accounts are all over the place,” Thompson said. “Some clients will only keep enough to pay for immediate expenses (e.g., $10,000) and others will have $150,000 in checking on any given day.”

For savings, aim to keep three to six months' worth of expenses in a high-yield savings account, but note that any amount can be beneficial in a financial emergency. For checking, an ideal amount is generally one to two months' worth of living expenses plus a 30% buffer.

Safety: As noted, most high-yield savings accounts are either FDIC or NCUA insured for up to $250,000. Moreover, as deposit accounts, they're not susceptible to the ebbs and flows of the market, so there's little to no chance you'll lose the money you deposit into one.

Is $1,000 a month enough to live on after bills?

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

Cash equivalents are financial instruments that are almost as liquid as cash and are popular investments for millionaires. Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills.

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

10x your annual salary by 67

To fund an “above average” retirement lifestyle—where you spend 55% of your preretirement income—Fidelity recommends having 12 times your income saved at age 67, which is the normal Social Security retirement age.

On a $60,000 salary, which roughly translates to $50,000 after taxes (depending on your location and tax rates), 60% would be about $30,000 per year, or $2,500 per month. Savings (20%): This portion should be allocated towards your savings, investments, emergency funds, or debt repayment.