What is a benefit of using a savings account instead of a checking account?

Traditional savings accounts earn a bit more interest than a checking account because you're letting your bank hold onto your money for an extended period of time. While your cash sits in the account, banks use it to finance their investments and lending.

Why does a savings account make a better investment than a checking account? Checking accounts have an annual fee. Savings accounts earn interest.

It allows individuals to deposit and store their money while earning a certain rate of interest on the deposited amount. The primary objective of a savings account is to encourage individuals to save money over some time, providing them with a safe and accessible place to keep their funds.

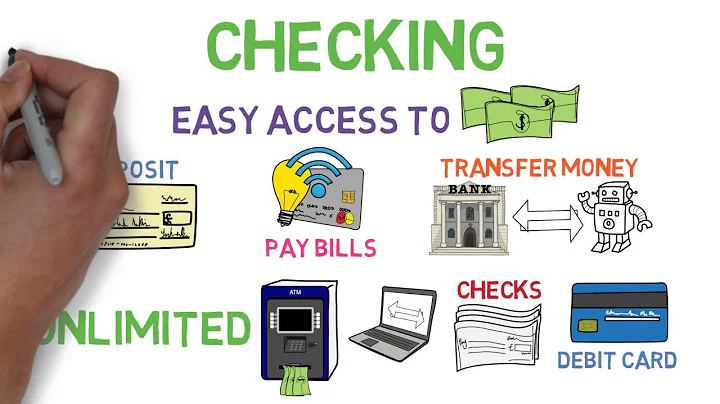

Checking accounts allow quick access to your funds on an ongoing basis, and some checking accounts are interest bearing. Savings accounts have withdrawal limits, are interest bearing, and are typically used for a financial goal or specific purpose (vacation, home remodel, etc).

With FDIC insurance, savings accounts provide peace of mind, ensuring up to $250,000** of your savings is protected. Savings accounts allow your money to work for you by earning interest over time and facilitating automatic bill payments, contributing to effective financial management.

Traditional savings accounts earn a bit more interest than a checking account because you're letting your bank hold onto your money for an extended period of time. While your cash sits in the account, banks use it to finance their investments and lending. They share a very small portion of their earnings with you.

Key takeaways. A checking account is for managing your day-to-day finances such as paying bills, making debit card transactions and writing checks. A savings account is for storing funds for emergencies or short-term goals, and the money typically earns a modest amount of interest.

A tiered rate savings account with unlimited deposits and unlimited withdrawals. $5,000 minimum opening deposit. Keep a $5,000 minimum balance each month and avoid a $10 monthly fee. Unlimited deposits.

- Bank accounts offer convenience. For example, if you have a checking account, you can easily pay by check or through online bill pay. ...

- Bank accounts are safe. Your money will be protected from theft and fires. ...

- It's an easy way to save money. ...

- Bank accounts are cheaper.

Savings accounts may have some limitations on how often you can withdraw funds, but generally offer exceptional flexibility that's ideal for building an emergency fund, saving for a short-term goal like buying a car or going on vacation, or simply sweeping surplus cash you don't need in your checking account so it can ...

Is savings account safer than checking?

In the traditional sense, checking and savings accounts are both incredibly safe places to keep your money. The National Credit Union Administration (NCUA) automatically guarantees accounts up to $250,000 for each member of a federally insured credit union.

If you're just looking to pay for everyday expenses, a checking account is the way to go. If you're focusing on growing your money, a savings account is a better fit. Regardless of the account type you choose, make sure you pick one suited to your financial needs and goals.

Typically, savings accounts offer much higher APYs than checking accounts. Lowers spending temptation. Unlike checking accounts, savings accounts don't offer linked debit cards, unlimited withdrawals, or checks so it's not as easy to access cash in a pinch.

- Interest Rates Can Vary. Interest rates for both traditional and high-yield savings accounts can vary along with the federal funds rate, the benchmark interest rate set by the Federal Reserve. ...

- May Have Minimum Balance Requirements. ...

- May Charge Fees. ...

- Interest Is Taxable.

Having adequate savings enables you to live a more fulfilled life. You are more likely to be less stressed about your future goals like retirement or unexpected expenses like healthcare. Savings allow you to be relieved and at ease, knowing you have sufficient funds to navigate different situations in life.

A savings account is a type of bank account designed for saving money that you don't plan to spend right away. Like a checking account, you can make withdrawals and access the money as needed. But with savings accounts, the bank pays you compounding interest just for keeping funds in your account.

In addition to earning interest, money in a deposit savings account is readily available. One of the biggest advantages of a savings account is that your money is fully accessible to you. You have access to your money through an ATM, online banking, our mobile app, or a transaction with a teller at one of our branches.

Savings accounts pay interest on balances. Checking accounts generally don't, and the ones that do tend to offer very low interest rates. Both types of accounts allow direct deposit of your paycheck, are federally insured up to $250,000 and may give you access to Mobile and Online Banking.

Checking accounts are better for regular transactions such as purchases, bill payments and ATM withdrawals. They typically earn less interest — or none. Savings accounts are better for storing money. Your funds typically earn more interest.

The best type of account is the one that fits your current financial goals and needs. Checking accounts can help you handle all of your daily spending and recurring bills, while savings accounts can help you build your savings, protect you from unexpected expenses and help meet your savings goals.

How much cash should you carry?

“We would recommend between $100 to $300 of cash in your wallet, but also having a reserve of $1,000 or so in a safe at home,” Anderson says. Depending on your spending habits, a couple hundred dollars may be more than enough for your daily expenses or not enough.

Low return – although consumers can earn interest, they offer relatively lower rates. Taxes – there are no tax benefits for putting money into a savings account. In fact, if a consumer accumulates a big enough balance, they will pay taxes on the interest they earn each year.

Which Bank Gives 7% Interest Rate? Currently, no banks are offering 7% interest on savings accounts, but some do offer a 7% APY on other products. For example, OnPath Federal Credit Union currently offers a 7% APY on average daily checking account balances up to and under $10,000.

Unless your bank has set a withdrawal limit of its own, you are free to take as much out of your bank account as you would like. It is, after all, your money. Here's the catch: If you withdraw $10,000 or more, it will trigger federal reporting requirements.

Most financial experts suggest you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000. Personal finance guru Suze Orman advises an eight-month emergency fund because that's about how long it takes the average person to find a job.