The fintech market is growing with each passing year.

There are many things contributing to the expanding market.

Increasingly productive technological innovations within the space, improving accessibility, and reduced costs are each major factors.

And as a result, consumer demand is rocketing.

We’ll explore these further and delve into the stats behind the growing industry:

- Fintech Industry Highlights

- Fintech Market Size

- Fintech Market Growth Projections

- Growth Drivers In The Fintech Space

- Key Players In The Fintech Market

- Fintech Market Breakdown By Region

- Digital Banking Growth

Fintech Industry Highlights

- The global fintech market is estimated to be worth $167.54 billion

- The fintech space is set to surpass $400 billion by 2027

- The fintech market is growing at a CAGR of 25.18%

- Over 26,000 fintech startups were launched in 2021

- In total, an estimated $8.49 trillion of digital payments were made in 2022

Fintech Market Size

According to the latest available data, the global fintech market is worth approximately $167.54 billion.

Fintech is rapidly reaching new heights as consumers continue to switch over from traditional in-person banking and embrace new solutions such as e-wallets, mobile banking, and cryptocurrency.

In fact, in just one year, the fintech market grew from an estimated $105.41 billion in 2021 to $131.95 billion in 2022.

Source: Market Data Forecast

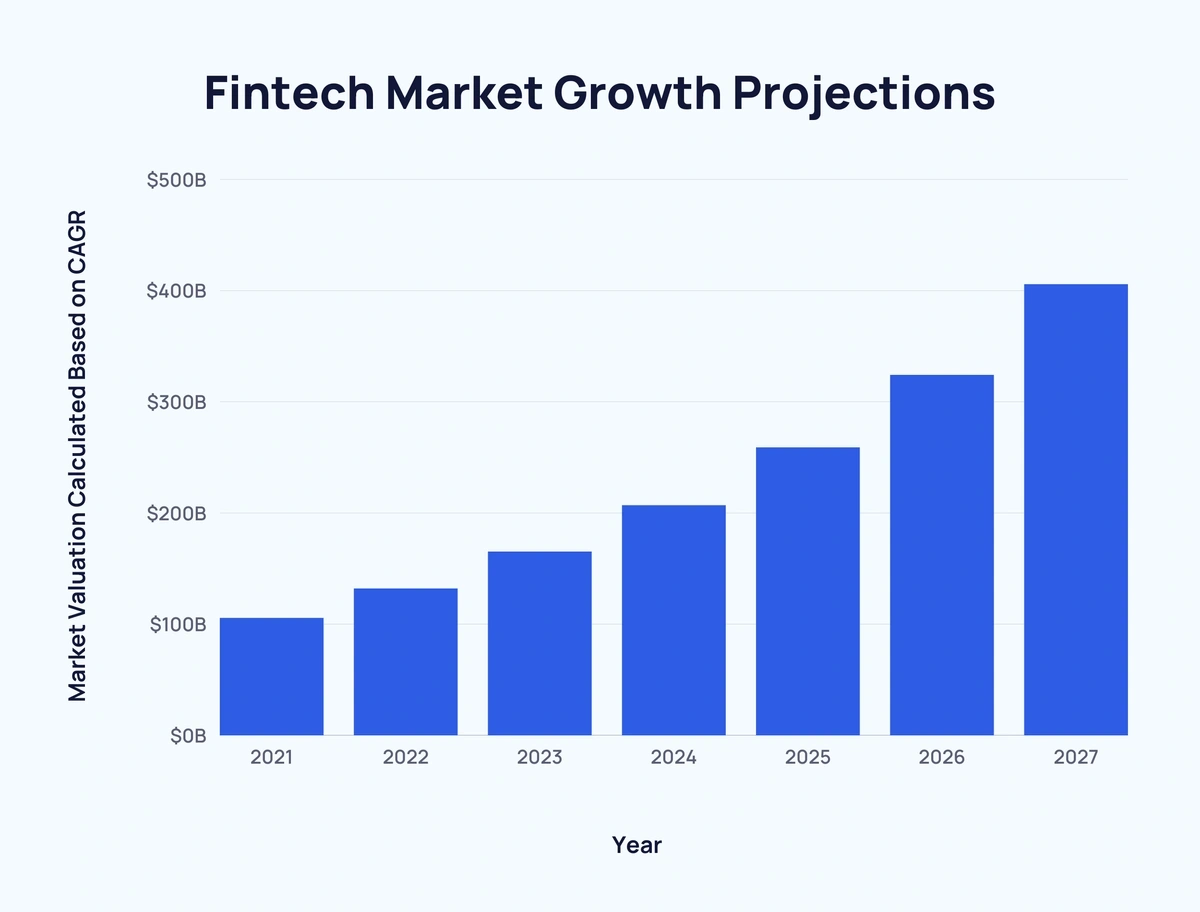

Fintech Market Growth Projections

By 2028, this fintech industry is projected to grow to$514.9 billion at a compound annual growth rate (CAGR) of 25.18%.

Here’s a look at how the fintech market is set to progress over the next half-decade:

| Year | Market Valuation Calculated Based on CAGR |

| 2021 | $105.41 billion |

| 2022 | $131.95 billion |

| 2023 | $165.17 billion |

| 2024 | $206.76 billion |

| 2025 | $258.83 billion |

| 2026 | $324 billion |

| 2027 | $405.58 billion |

| 2028 | $514.9 billion |

Source: Market Data Forecast

Growth Drivers in the Fintech Space

There are several key factors behind the continued rapid growth within the fintech space.

Advancing automation tech and an ever-growing array of online and app-based services are perhaps the most important factors driving fintech’s growth. Improved accessibility and reduced costs mean fintech solutions are more readily available to would-be consumers.

In addition, lenient regulations in the space and changing consumer demands/expectations have further boosted the market.

Source: MadAppGang

Key Players in the Fintech Market

- Visa (US)

- Ant Financial (China)

- Mastercard (US)

- Tencent (China)

- Intuit (US)

- Stripe (Ireland)

- PayPal (US)

- Fiserv (US)

- Klarna (Sweden)

- Nubank (Brazil)

- Adyen (Netherlands)

- Checkout.com (UK)

- Gojek (Indonesia)

- Square (US)

- Revolut (UK)

- FTX (Hong Kong)

- Chime (US)

- Ripple (US)

- Lufax (China)

- Blockchain.com (Luxembourg)

Source: CFTE

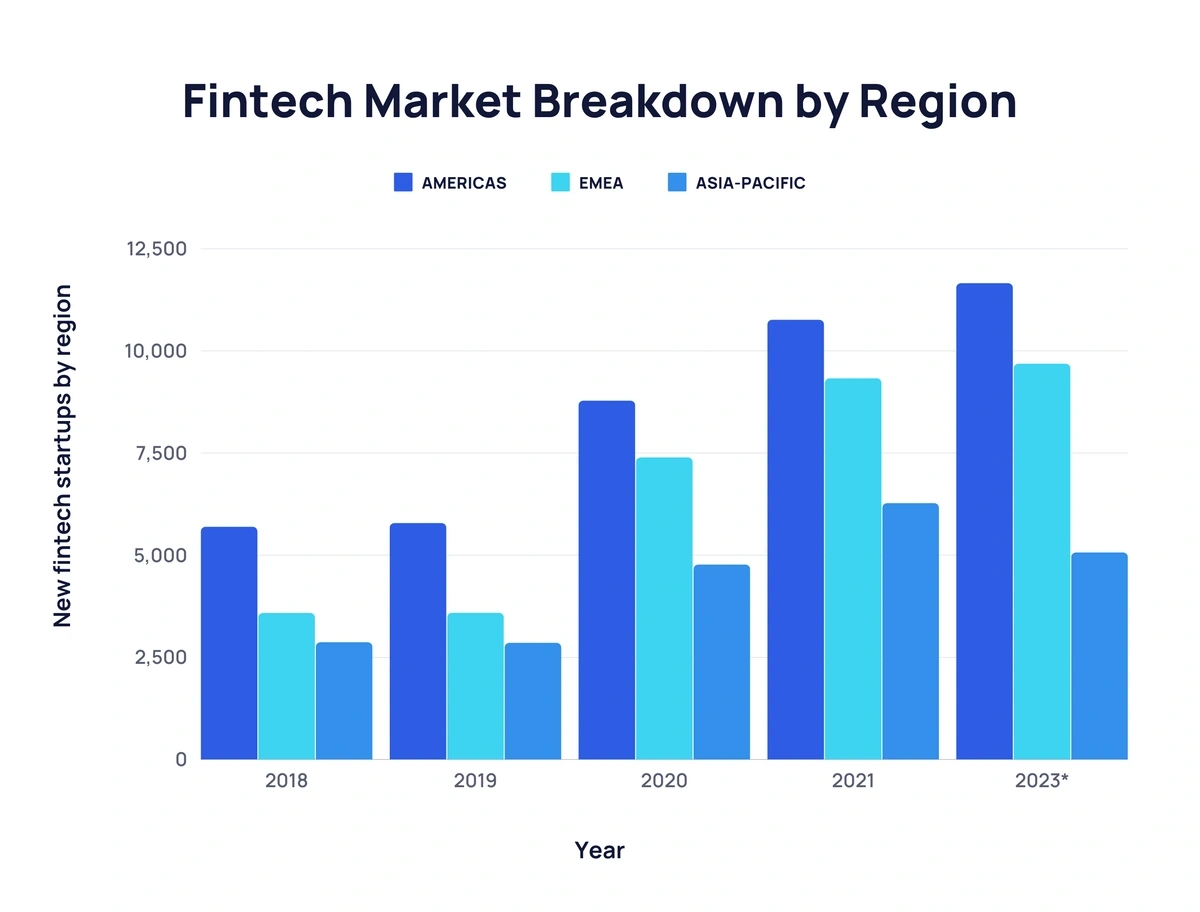

Fintech Market Breakdown by Region

The fintech market is seeing a sharp increase in startups popping up.

The Americas are leading the way in terms of region. But Europe, the Middle East, and Africa (EMEA) are catching up.

Here’s a breakdown of new fintech startups by region:

| Year | Americas | EMEA | Asia-Pacific | Total |

| 2018 | 5,686 | 3,581 | 2,864 | 12,131 |

| 2019 | 5,779 | 3,583 | 2,849 | 12,211 |

| 2020 | 8,775 | 7,385 | 4,765 | 20,925 |

| 2021 | 10,755 | 9,323 | 6,268 | 26,346 |

| 2023* | 11,651 | 9,681 | 5,061 | 26,393 |

* As of May 2023

Source: BCG

Digital Banking Growth

Digital banking is the largest segment within the fintech space. In the US, digital banking has grown steadily in adoption year-over-year from 61.3% in 2018 to 65.3% in 2022.

And an estimated $8.49 trillion of digital payments will be processed globally during the course of this year. Increasing at a CAGR of 12.31% until 2027.

China has the highest cumulative transaction value at $3.5 trillion.

Conclusion

The fintech market is going from strength to strength.

Steadily increasing adoption, greater consumer accessibility, and a growing number of startups in the space all combine for a bright future.